Student Development

Explore Development Opportunities

Study Skills

No matter what your grades are, everyone needs some guidance to find success in the classroom. Here are some resources to help you develop the best study habits and skills you’ll need to get your degree:

What are Office Hours? – by Andrew Ishak

Time Management: TCU Video Project Series

Focus 2 Self-Assessment

Many people struggle with choosing an academic major during school, or job industry after graduation, but choosing a path is important when choosing your classes, internships and other career opportunities.

Focus 2 combines self-assessment, career and major exploration, decision-making and planning in one place. By matching your assessment results to career options and majors/programs for your consideration, FOCUS 2 guides you through a career and education decision-making model to help you make informed career decisions and take action in planning your future.

To use this free service, register to create an account with the access code collegefund. From there, you can take each test- personality, interests, values, and skills- to build your academic and career planning profile. Print your profile to share with an academic or career counselor or mentor to discuss your career plan or transition to a new profession.

Money Management

It is also important to understand budgeting, credit, and debt management – to help you to make responsible decisions in school, and prepare for your financial life after school. Learn about the following topics in related posts — your financial future depends on it.

- Money Management — Developing Common Cents (College Fund)

- Per Cap (First Nations Development Institute)

- Financial Skills for Families (First Nations Development Institute)

- Developing Your Vision: Managing Your Money

- Your First Bank Account

- Childcare Costs (and Ways to Reduce Them)

- When Your Child Has Special Needs

- Caring For Aging Parents

- Children and Family Considerations

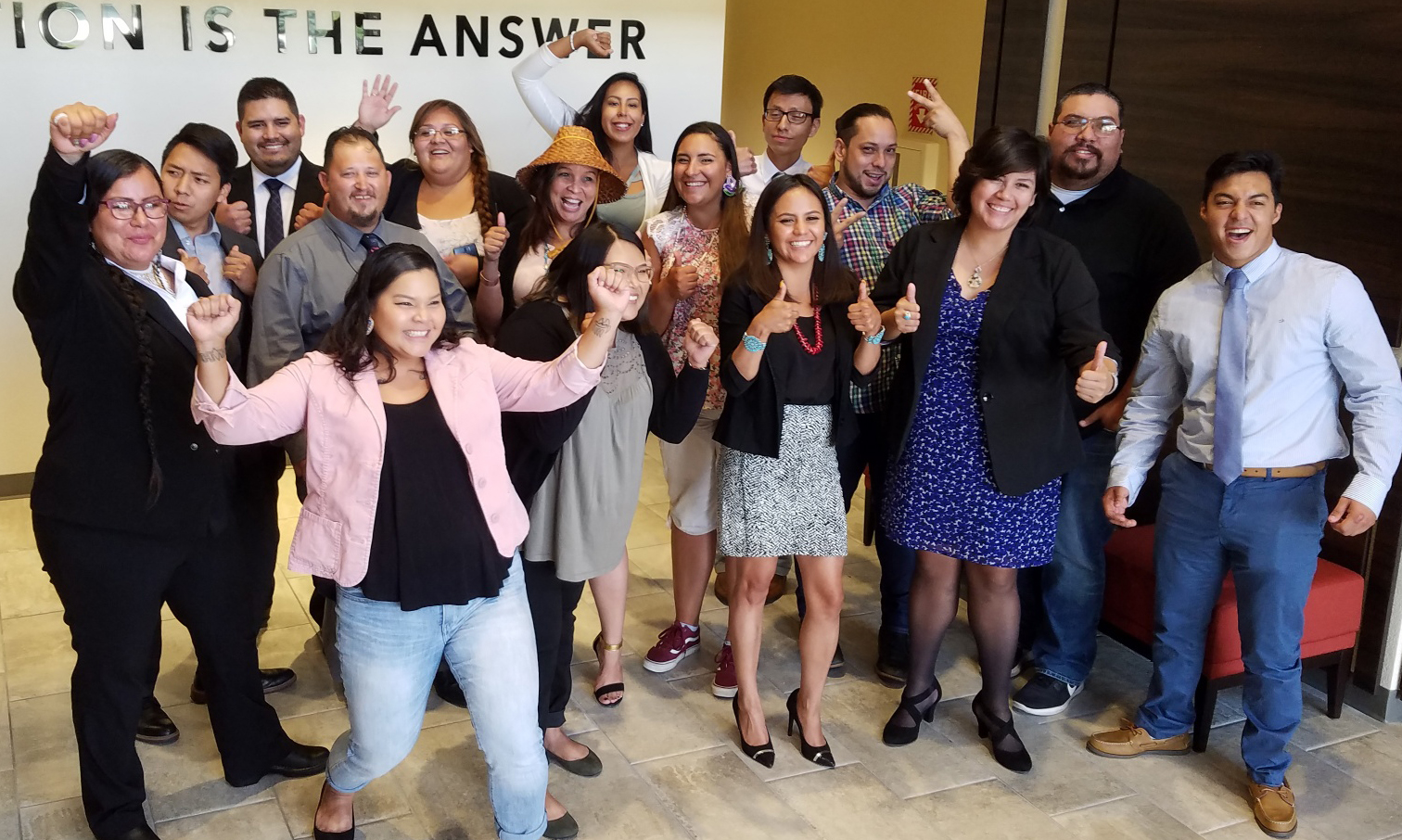

Student Ambassador Program

The American Indian College Fund Ambassador Program was established in 2015 to strengthen students’ and alumni personal and professional skills and to represent the College Fund.

Our Blogs

Great.com Talks With… American Indian College Fund

Cheryl Crazy Bull, President and CEO of the American Indian College Fund, and Dina Horwedel, Director of Public Education, share news about the College Fund’s mission and work with Native students and communities on Great.com, a podcast highlighting the good work that organizations are doing worldwide.

American Indian College Fund Mourns Loss of Robert Bible, President of the College of Muscogee to COVID-19

The American Indian College Fund and its governing board of trustees is saddened to learn of the death of Robert Bible, President of the College of Muscogee Nation (CMN), a tribal college in Okmulgee, Oklahoma. President Bible was known throughout Indian Country for his selfless dedication to his community and for his outstanding contributions to American Indian higher education with his humility.

Charity Navigator Highlights the American Indian College Fund

Charity Navigator, a respected charity watchdog organization, is highlighting Native American charities on its blog as part of its strengthened commitment to promoting a more equitable social sector by encouraging both organizations and donors to consider aspects of diversity, equity, and inclusion in their decision-making.

Charitable Giving Opportunity Under CARES Act

You may be able to decrease your taxable income in 2020 through The CARES Act. The law allows taxpayers who do not itemize deductions to take up to a $300 deduction for a cash contribution made to qualifying organizations such as the American Indian College Fund in 2020. In previous tax years and normal tax rules, you cannot deduct charitable donations unless you itemize deductions.

For those who do itemize deductions, the CARES ACT has suspended limits on charitable contributions for the tax year 2020. This year taxpayers can deduct donations for up to 100% of their adjusted gross income. Previously the rules allowed deductions up to 60% of your income. For those in a position to do so, one can give up to 100% of their income and owe zero in taxes. Donations must be made by midnight, December 31, 2020.

American Indian College Fund Teams with Ford Motor Company Fund to Provide Native-Serving Organizations with $134,611 in Protective Gear

Native American communities suffer from coronavirus infection rates greater than 3.5 times that of white people, according to the Centers for Disease Control. So, when the Ford Motor Company Fund (the Ford Fund), a longtime supporter of the American Indian College Fund, proposed partnering with College Fund to deliver personal protective equipment (PPE) to non-profit organizations serving Native communities and Colorado communities in need, the College Fund jumped at the chance.

American Indian College Fund to Award 10 Tribal Colleges and Universities with Grants for Native Arts Enrichment and Expansion of Existing Programs and Curriculum Development

The American Indian College Fund is awarding $900,000 in grants to nine tribal colleges and universities for the two-and-a-half-year program to establish new Native arts programs and to expand existing Native arts programs at tribal colleges and universities (TCUs).