Our Blogs

Celebrate National Tribal Colleges and Universities Week!

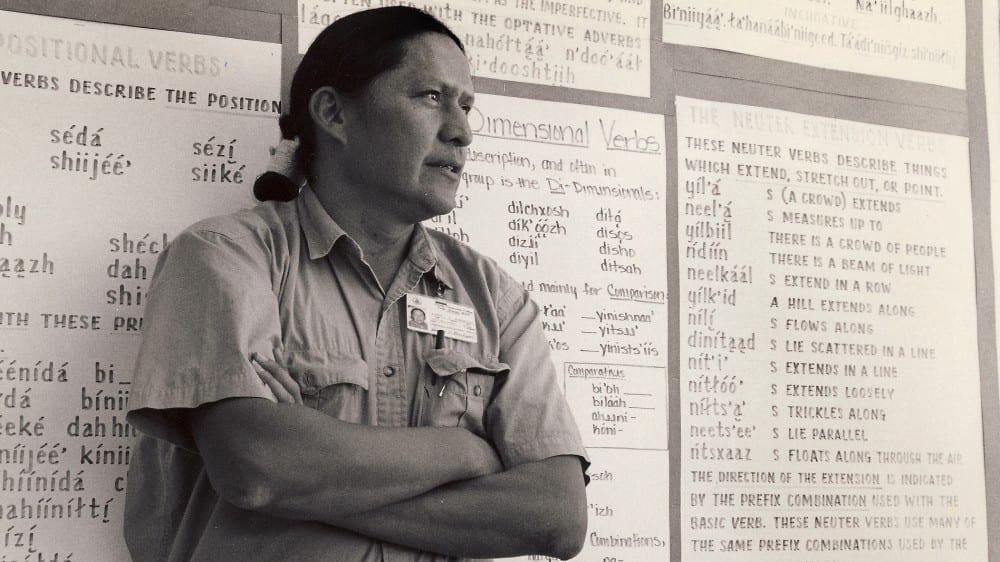

The American Indian College Fund is excited to share that the U.S. Congress designated the week beginning February 28, 2021 as National Tribal Colleges and Universities Week. The College Fund serves the 35 accredited higher education institutions located on more than 70 campuses in 13 states across the nation, providing them with programmatic and infrastructure support.

Advocate for Native Representation in Education and Support Deb Haaland’s Confirmation as Secretary of Interior

Tell all U.S. senators that Representative Deb Haaland has the experience and leadership we need at the U.S. Department of Interior. The American Indian College Fund is joining allied Native organizations to advocate for Haaland’s confirmation as part of #DebForInterior Week of Action from Monday, February 22 to Wednesday, February 24. Join us during the #DebForInterior Week of Action to generate a groundswell of public awareness and support for Congresswoman Haaland for her confirmation.

Our Students Give Me Hope

| 2021 E-NEWSLETTER | VOLUME 21, ISSUE 1 | Circle of Hope Our Students Give Me Hope And today I need it – I write this as December is starting and I anticipate spending Christmas (just as I did Thanksgiving) without my family because of the surge in COVID-19 cases...

Motivation and Perseverance

By Kateri Montileaux, OLC GED Director Although TCUs are still dealing with the COVID-19 pandemic along with the rest of the world, Oglala Lakota College (OLC) has continued to make a positive impact in its communities with the Dollar General American Indian and...

U.S. Takes Historic Steps Towards Greater Equity

At the American Indian College Fund, we will continue our work to provide equitable access to a higher education for every Native American who wants one, while reinforcing the importance of civic education and engagement. We want and need more of our graduates at the table, representing our communities, so that every Native child can fulfill their dream—and Dr. King’s.

College Fund’s Work Featured on Denver 7 (ABC) Mile High Living Segment

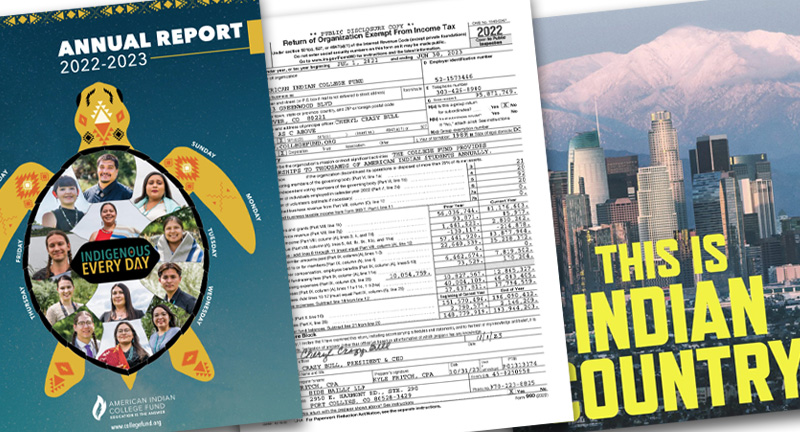

Cheryl Crazy Bull, President and CEO of the American Indian College Fund (the College Fund), was interviewed on Denver’s Mile High Living, a television segment on Channel 7 (ABC) in Denver that looks at the impact that local organizations are making in Denver, where the College Fund is headquartered, and the greater nation.

AT&T Gives $1.5 Million in Pandemic-Related Supplies to More Than 20 Tribal Colleges and Universities

The American Indian College Fund and the American Indian Higher Education Consortium are receiving $1.5M in pandemic-related supplies including hand sanitizer, disinfectant and gloves. Both organizations are working with AT&T to distribute the supplies to more than 20 tribal colleges and universities (TCUs) across the country.

American Indian College Fund Statement on Events at U.S. Capitol

The attack last week on the U.S. Capitol was an attack on every peaceful citizen who believes in a representational democracy in which all races, genders, ethnicities, and creeds have a place at the table.

Structural Racism in Education Video Presentation Featuring Cheryl Crazy Bull

Cheryl Crazy Bull, President and CEO of the American Indian College Fund, will participate in a panel discussion about structural racism in our education system and its impact on economic outcomes for all Americans.

Great.com Talks With… American Indian College Fund

Cheryl Crazy Bull, President and CEO of the American Indian College Fund, and Dina Horwedel, Director of Public Education, share news about the College Fund’s mission and work with Native students and communities on Great.com, a podcast highlighting the good work that organizations are doing worldwide.