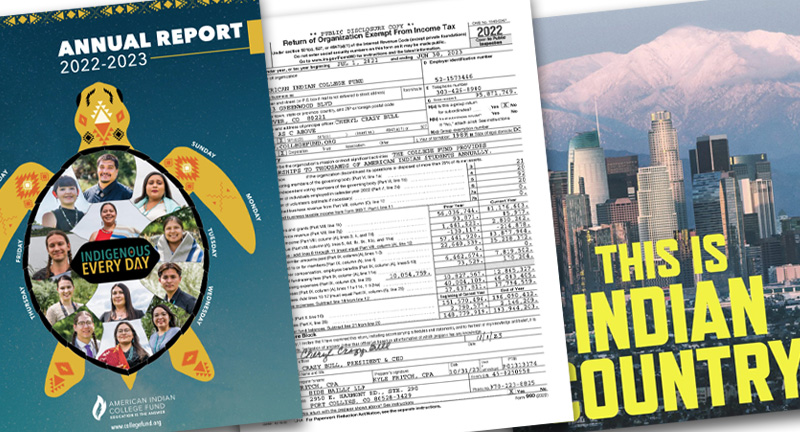

Cheryl Crazy Bull, President and CEO of the American Indian College Fund (the College Fund), was interviewed on Denver’s Mile High Living, a television segment on Channel 7 (ABC) in Denver that looks at the impact that local organizations are making in Denver, where the College Fund is headquartered, and the greater nation.