Sinte Gleska University’s high school equivalency students become grounded in their cultural identities as they lead community engagement efforts through Native Arts workshops.

Sinte Gleska University’s high school equivalency students become grounded in their cultural identities as they lead community engagement efforts through Native Arts workshops.

American Indian College Fund President and CEO Cheryl Crazy Bull co-authored a chapter in the recently released book “On Indian Ground – A Return to Indigenous Knowledge: Generating Hope, Leadership, and Sovereignty Through Education.” This work, focused on the Northern Plains, is one of a ten-book series from Information Age Publishing that explores American Indian, Alaska Native, and Native Hawaiian education in different regions.

Jeri’s first step to achieving her dream of serving and supporting Native youth is completing her high school equivalency degree at Lac Courte Oreilles Ojibwe University.

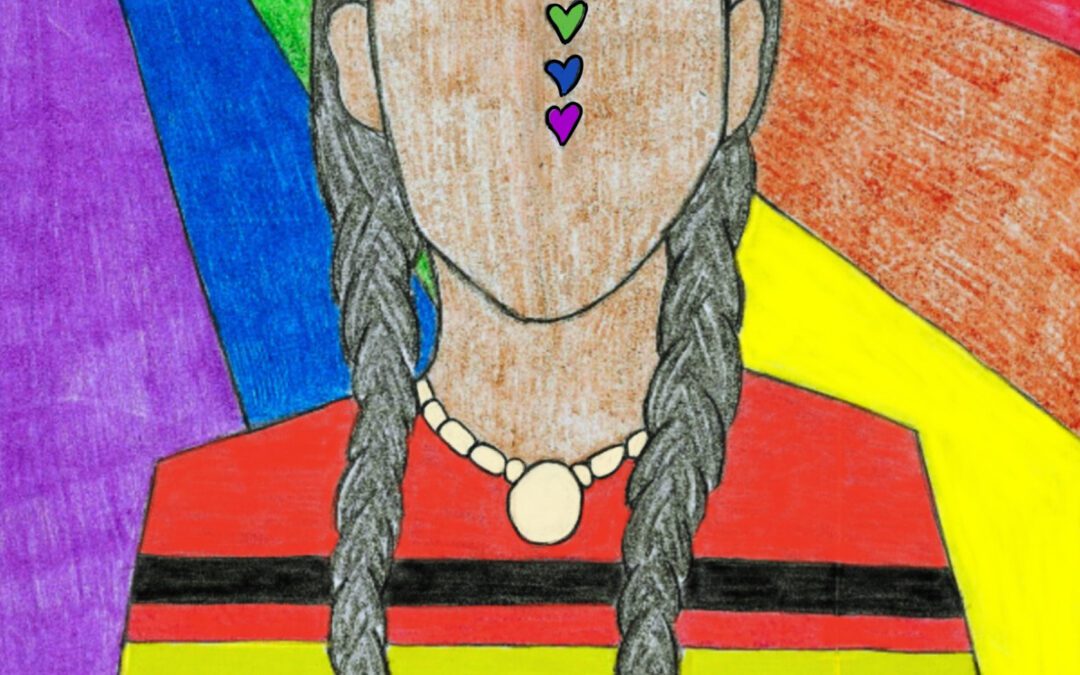

Travis Richard (Cheyenne River Sioux Tribe) has been named as the 2023 winner of the American Indian College Fund’s (College Fund) Two-Spirit and LGBTQ+ Initiatives T-Shirt Design Contest. The goal of this contest was to raise visibility of 2SLGBTQ+ identity at tribal colleges and universities (TCUs) as well as in Native communities.

In her latest blog, American Indian College Fund President and CEO Cheryl Crazy Bull offers a statement on the recent U.S. Supreme Court decision in Haaland v. Brackeen. Learn about the importance of this case not only in ensuring that Native children have the ability to be raised in their own communities but in reaffirming the sovereignty of Tribal nations.