Looking for a good read? The Think Indian Book Club recommends these titles for your own book group or personal reading pleasure.

Looking for a good read? The Think Indian Book Club recommends these titles for your own book group or personal reading pleasure.

Deshawna Anderson, a College Fund scholar and Little Big Horn College student, honored murdered and missing indigenous people with her Pendleton blanket design. The grave issue impacts Native people disproportionately. The American Indian College Fund joins the...

The American Indian College Fund urges education about Native peoples, cultures, and histories for media and citizens.

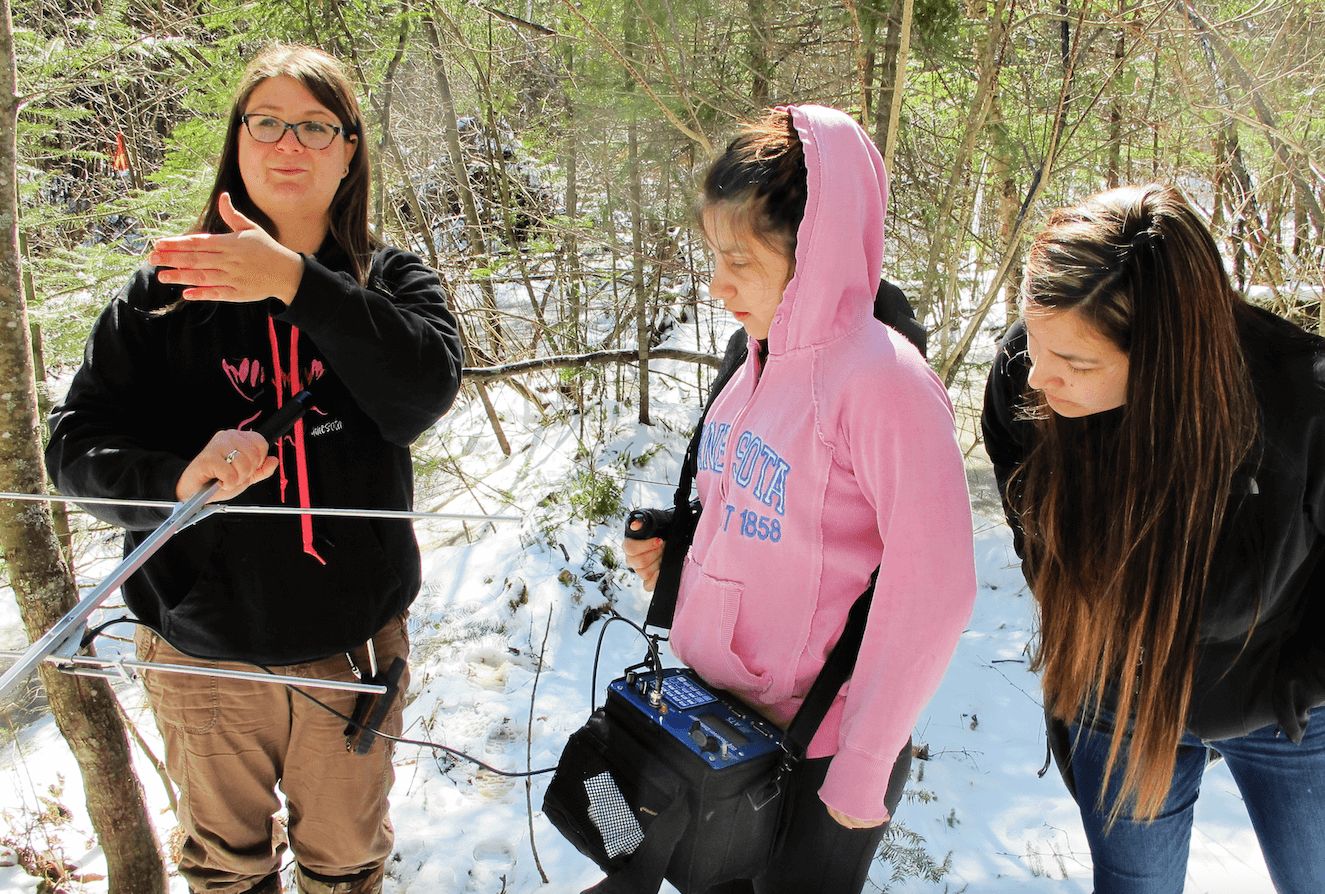

People across the nation will be celebrating Earth Day this Thursday, April 22. But for Tribal communities, Earth Day is year-round. The American Indian College Fund provides Tribal colleges and universities and their students study and internship opportunities that allow them to make a deeper impact on the environmental health of their communities.

by Sherman Marshall, SGU Adult Basic Education Director For Debbie Burnette, joining Sinte Gleska University’s (SGU) Adult Basic Education (ABE) department in March 2020 was like coming home. Debbie’s connection with the ABE department goes back to 1979 when she...

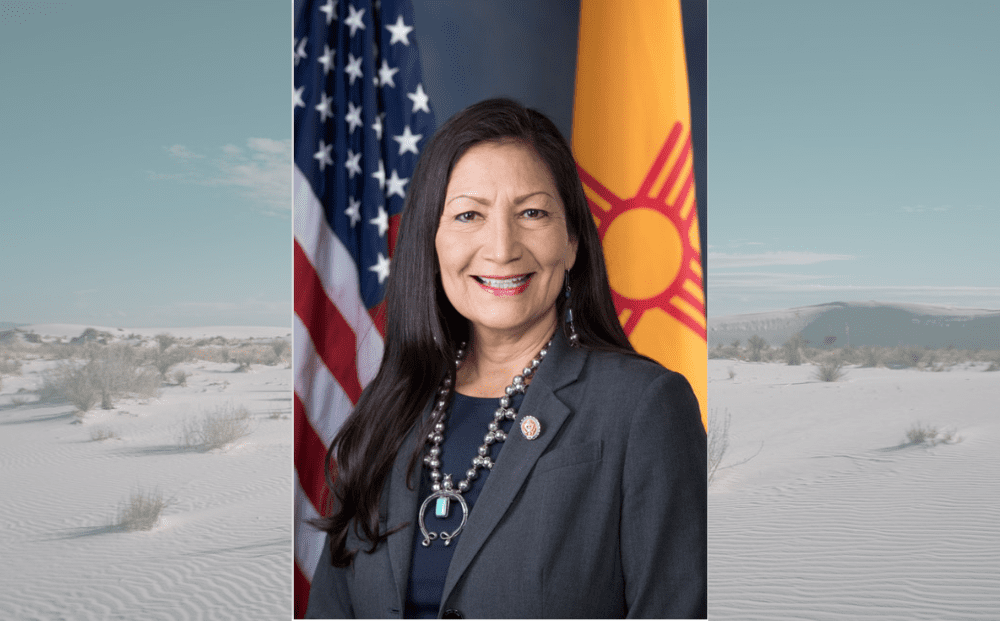

Deb Haaland will be a leader of the U.S. Department of Interior for all of America. But as an Indigenous woman who lives her identity, she will honor our ancestors and while making decisions about future generations of Indian people as a visible part of all of America.

The American Indian College Fund’s approach to eliminating financial barriers to college for Native students is featured on cardrate.com. David Bledsoe, Student Engagement and Communications Manager at the College Fund, speaks about the Full Circle Scholarship Program (accepting applications until May 31 at collegefund.org/scholarships) and career readiness programs the College Fund offers.

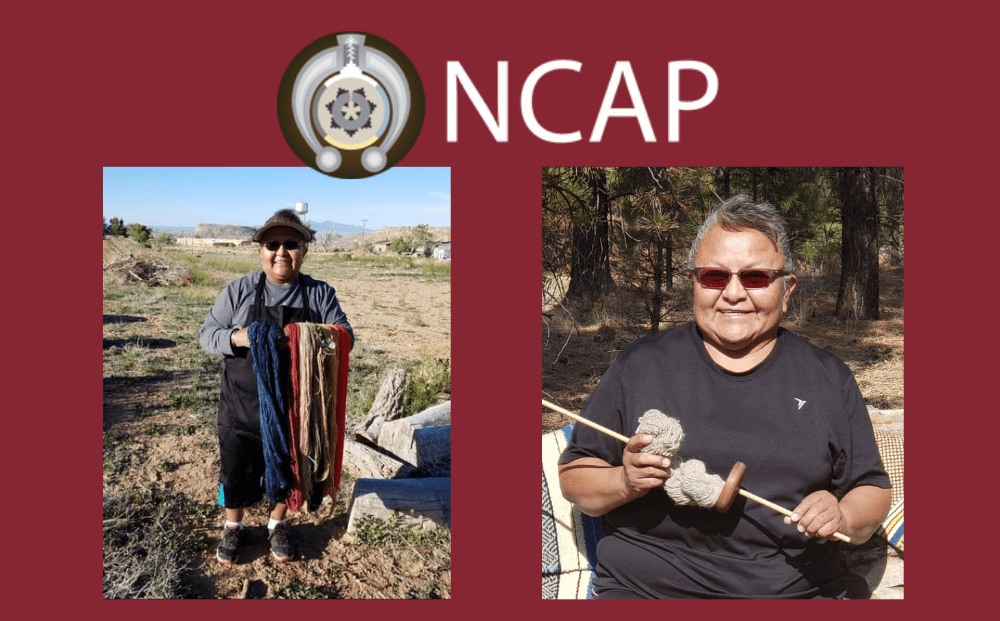

Tammy Martin, a member of the American Indian College Fund’s Indigenous Visionaries program, interviewed a fellow community member and Navajo weaver, Gloria Begay, about how her craft helped her as a Navajo woman. In their conversation Begay shared how weaving was a...

TOCC recently had its first student complete the CCP. Monique started the GED program in the summer of 2018. Monique had dropped out of high school three years earlier and says the bad learning environment made it difficult to care about her education.

The American Indian College Fund is excited to share that the U.S. Congress designated the week beginning February 28, 2021 as National Tribal Colleges and Universities Week. The College Fund serves the 35 accredited higher education institutions located on more than 70 campuses in 13 states across the nation, providing them with programmatic and infrastructure support.